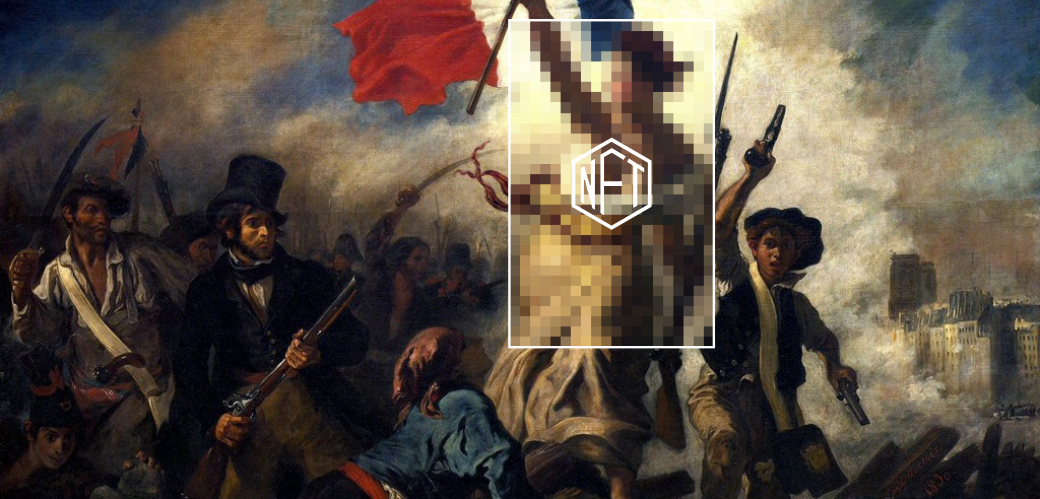

This article is not about what is NFT or how to make money with NFT. This time, we want to answer a more utilitarian question. Since the ownership of an NFT doesn't confer much inherent value (except the item authenticity and copyright), we want to investigate the future of NFT.

The story of NFT reminds us of the Dutch Tulip bulb market bubble, that took place in Holland. At that time the speculation drove the tulip bulbs’ value to extremes. So the tulip bulbs were traded for more than a person’s annual salary. Eventually, tulipmania crashes in the mid-1600s and provided us with a valuable lesson. Something had value until it didn't.

So, we asked the leaders from different industries to comment on the question What is the future of NFT, or is it just a fad? to provide meaningful discourse on this matter. Based on received replies we notice that peoples’ opinions were divided. Nevertheless, the majority of respondents see NFT technology is full of potential to change a lot of industries.

Fad or not a Fad. That’s the Question

Due to the global pandemic, much of our life has gone digital. Even before that, for decades, we have had unique in-game tokens, swords and other collectibles online. It’s not a surprise, that uniquely tagged, these items turned into NFTs. This concept has been around for many years, but the crypto boom and news of high-value sales of digital art via NFTs has led to an explosion in interest, lately.

However, the problem with NFT might be the confusion between price vs value. As Oscar Wilde once said, “A fool is someone who knows the price of everything and the value of nothing”. David Reisher, CEO at LegalAdvice commented on value vs price in terms of NFT:

“All too often a person believes that the price of an asset reflects its underlying value without taking the time to consider the disconnect between the two. And perhaps NFT is no exception to this statement that price and value being confused.

There is little doubt that the NFT craze will end in a flood of tears when all of the hype becomes a whisper. The true value of an asset does not require constant hype to keep the price afloat. The actual price of an asset should be proximate to its underlying value. Such an appraisal of an item's value requires a deep analysis of the fundamentals that take into account a whole host of factors that may include utility, rareness, importance, and sales based on past history. It is likely that when the NFT bubble crashes there will be many lawsuits by those that feel bamboozled.”

Most certainly, as with every new phenomenon, NFT is filled with hype. However, history tells us to be careful about dismissing NFTs as a passing fad, since the importance of technological innovations often becomes clearer once the hype dies down. This phenomenon is captured well in US consultancy Gartner’s hype cycle, which illustrates the typical progression of new technology. With NFTs, we are probably emerging from the “peak of inflated expectations” on a journey towards the “plateau of productivity”.

What we know for sure is that the NFT’s underlying tech has a few issues with scalability and network fees which make only crazy high prices profitable. This could lead to the foundations of creating a bubble that will eventually burst.

Emmanuel Fabry, blockchain enthusiast and founder of Tremorz pointed out another reason why NFT could be seen as a fad:

“... these networks haven't matured yet, and there is plenty of space for others to join, this discredits again the crazy prices of a Jpeg because we don't even know who will win the network race - aka, the one with the most users and decentralization. So tomorrow, they could be worth nothing. The most likely scenario is multiple networks 'winning' and allowing for interoperability between themselves.”

Another suggestion is that the buzz around NFT is amplified by speculations. According to Nodari Kolmakhidze, CFO at Cindicator, “Besides the great fundamentals behind digital art, NFT is also attracting speculators and traders. ... Therefore, I believe, NFT platforms like Rarible, Flow, OpenSea could grow and become the new Coinbase and Binance - traders don’t really care what to trade.” At the same time, the respondent admits that “there is nothing bad about it” since if there would be no secondary market, fewer artists would create fascinating things.

In this light, NFTs are the newcomers challenging how we perceive and register ownership of assets. And the tension between innovation and incumbency also contributes to the skepticism that always surrounds such new technologies.

Still, there is a common opinion that NFT is currently in the bubble which should be pass soon. Thus, Marie Tatibouet, CMO at Gate.io is one of many who thinks so:

“I don’t think NFT’s are a fad, I do however believe that we are currently in a bubble right now. However, this is expected because of how revolutionary it is. No matter what, “ownership” means something and will always have value. It’s not just mere emotional attachment, because NFTs can be hardcore assets that can be transferred between parties. Regarding its future, I believe that once the hype has died down, we will start seeing some serious use cases.”

Certainly, NFT is a Revolution!

Without a doubt, NFT solves problems that exist on the internet today. As everything becomes more digital, there’s a need to replicate the properties of physical items, like uniqueness and proof of ownership. NFT represents an abstracted version of ownership with a way to transfer this relationship easily from one person to another. The real revolutionary part comes when you think about what this could mean.

“The idea of NFTs has the ability to go beyond innovation and contribute to the development of an entirely different market for buying and selling digital property. Or they could lose relevance over time as the internet as a whole continues to move on to another trend in pursuit of something new.” - James Page, a Crypto Technical Writer at Crypto Head.

NFTs create opportunities for new business models that didn’t exist before. NFTs have the potential to serve as an innovative way for artists to monetize their digital art. Of course, you could always take screenshots or simply download their artworks, but this way people can prove “ownership” of the art and assign value to it. Everything else will merely be a worthless copy – just as you could get a copy of the Mona Lisa and hang it in your living room. It just wouldn’t be the same. Thus, artists can attach stipulations to an NFT that ensures they get some of the proceeds every time it gets resold, meaning they benefit if their work increases in value.

But beyond these fields, the potential of NFTs goes much further because they completely change the rules of ownership. Transactions in which ownership of something changes hands have usually depended on middlemen to establish trust in the transaction, exchange contracts and ensure that money changes hands.

“NFT art will likely die, NFT usage may not” that’s how Victor Huang, a blockchain cryptocurrency developer replied to the future of NFT:

“In the future, it may become significantly harder to copy and distribute digital content illegally, which can only be positive for countless industries. We may also see the tokenization of physical assets that require authenticity and proof of ownership. This could include things like passports, licenses and tickets, making it much harder to commit fraud and produce fakes of such documents”.

In fact, any mechanism which removes middlemen and enables trustless peer-to-peer trade upends a significant portion of the world as we’ve built it up so far. From land dealings to tracing the authenticity of E-passes and vaccination certificates without having to install an app that leaks your data. A lot of activities online rely on a third party.

None of this will be necessary for the future. Transactions recorded on blockchains are reliable because the information cannot be changed. Smart contracts can be used in place of lawyers and escrow accounts to automatically ensure that money and assets change hands and both parties honor their agreements. NFTs convert assets into tokens so that they can move around within this system.

That’s how Gary Nuttall, Emerging Technology Consultant at Distlytics Ltd commented on the value of NFT:

“If you think of an NFT simply as an entry on a blockchain that confers ownership on a digital image then you're going to struggle to figure out why there's such a frenzy of activity in this space. Abstracting the concept in that way devalues the merit of the idea and removes the emotional attachment. I argue the same is true with football (soccer) matches. Let's get this right, I travel hundreds of miles and then pay to watch a group of people kick a leather sphere around a field. But I could stay at home and watch it on TV for free! It's true with many things in life. Don't try to rationalise why others like something. Just accept that oif enough people want to buy something and enough want to sell it, then there's a market.”

What Happens Next to NFT?

Despite some skeptisism around the NFT boom, the promising numbers that sales in this sector are generating every day pointed out to the emerging new economy. According to Statista, NFT projects in 2020 were worth millions of US dollars. Michael Pastko, Founder and CEO of Satoshi's Close pointed out that:

“The mass consumer and media market does not yet fully grasp the transformational shifts that will come from the emerging NFT economy. Along with the concept of ownership - aside from the admittedly tricky question of where does copyright exists - is the concept of monetization from ownership. Token holders will ultimately be able to profit from ownership of media, just as occurs today.”

Thus, to transfer the rights to broadcast a track on the Internet, a musician does not have to sign a contract. Instead, they can use a corresponding blockchain and NFT. The NFTs representing real entities have a promising future. This is an additional step forward and a simplification of processes. The NFTs created to make money on hype also have pretty obvious prospects, but the investor has to define the potential of NFT type for themselves.

We believe that there is certainly a future for NFT for two reasons:

There is an emerging trend of transferring rights amongst different entities within the digital industry, and the trend is developing.

NFTs are digital by definition, and operations much easier in the digital environment.

George Chrysochou, a Global marketing manager at Financer.com elaborates on the immense potential that NFT has. He suggests a few sectors that could be revolutionized by NFT:

“Primary Sector: Assign certificates for composition/authenticity, and origin of raw materials such as precious stones, metals, and other commodities. Assign certificates of chemical tests and safety checks conducted to edibles.

Secondary Sector: Assign information for all operations throughout the manufacturing process. Assign certificates for the source, authenticity, unique traits, manufacturing methods, and safety standards for each final product. Perform reliable data analysis for the usage of final products and their effect on the consumers. Identify counterfeit products with a simple scan without laboratory analysis.

Tertiary Sector: Conduct instant, reliable security checks. Eliminate counterfeit votes during elections. Provide certified ownership rights to all types of physical and financial assets. Assign eternal commission rates to the original owners of any asset every time that it's sold. Efficiently track and enforce IP rights. Create transparent and accurate tax reports. Perform background checks for legal procedures. Provide verifiable digital IDs to the entire population that will be impossible to counterfeit.”

Final Thought

We believe, that NFTs will evolve. NFT has the potential to transform and revolutionize many sectors creating a new approach to ownership, verification and security. They have, after all, evolved to get to this place. Before Christie’s and Beeple and Grimes and Musk, we had Cryptopunks and Cryptokitties. And even before that, we’ve had non-fungible tokens used for everything from selling skins for online games to tracing food in supply chains.

What is different this time is how much more mainstream it got – and that’s something we can count on every iteration. And each evolution adds a layer of accessibility. In this light, NFTs are revolutionary.

If you’d like to add some arguments into this conversation, feel free to contact us, so we include your suggestions in the next article!

You may be interested in other NFT articles: