Nowadays paying with your credit card at the cafe, buying a new jacket online or even purchase software development for startups became as simple as it has never before. In fact, secured transactions are an endless opportunity to make your life easier and more convenient.

Currently, the crypto market is developing at a rapid pace with the diversity of online services. Therefore, along with the usage of traditional credit cards, people more often start using the digitized way of payments. Crypto projects are defined as various ways to do different manipulations (such as processing, having cryptocurrency wallets and participation in the digital currency exchanges) with the cryptocurrency and traditional financial instruments.

Check out 10 Best (and Safest) Cryptocurrencies to Invest in Right Now.

For those who are not familiar with the mentioned digital asset management definitions, we would like briefly elaborate on them. Thus, while cryptocurrency is a digital asset that uses strong cryptography to secure financial transactions; the cryptocurrency exchange is a business that allows users to trade cryptocurrencies for other assets using special platforms. Moreover, a cryptocurrency wallet is a program that stores private and public keys that can be used to receive or spend the cryptocurrency. There are several types of wallets:

Multisignature wallet which requires multiple parties to sign a transaction for any digital money can be spent;

Key derivation wallets which divide to deterministic (a single key to generate the entire tree of key pairs) and non-deterministic wallets (key randomly generated on its own and does not connected to a common key).

In fact, crypto projects provide financial services in the same way as traditional payment institutions and emoney institutions and should not neglect the subject of security. Therefore, maintaining cybersecurity is crucial in processing users payments and bank activity. In that regard, you should know more about PCI DSS and its influence on multiple levels of security. It will shed the light on some aspects of cybersecurity in relations to your payments methods, especially with the ongoing development of cryptocurrency these days.

Let’s define separately each component of the equation in relation to the secure financial terms online.

What is PCI DSS?

PCI DSS, in other words, the Payment Card Industry Data Security Standards is defined as an information security standard for organizations that handle branded credit cards from major card scheme. In fact, PCI DSS is the practice of preventing unauthorized access, use, disclosure, modification, destruction of information.

Initially, the intention was to create an additional level of protection for card issuers by ensuring that merchants meet minimum levels of security when they store, process, and transmit cardholder data. Yet currently it is a universal version of maintaining the security of online financial activity.

Although the PCI DSS should be implemented by all sectors especially the one that is related to financial operations, yet formal validation of PCI DSS compliance is not mandatory for all entities. Nowadays, both Visa and MasterCard require merchants and service providers to be validated according to the PCI DSS. Issuing banks have to secure sensitive data in a PCI DSS compliant manner. Acquiring banks are required to comply with PCI DSS as well as to have their compliance validated by means of an audit. In case of security breach, any compromised entity which was not comply with PCI DSS will have to pay fines.

What is Blockchain Technology?

You have probably heard about the most talked innovation in FinTech - blockchain. But pretty sure it is still not quite clear how does blockchain work. So, let’s figure out this together.

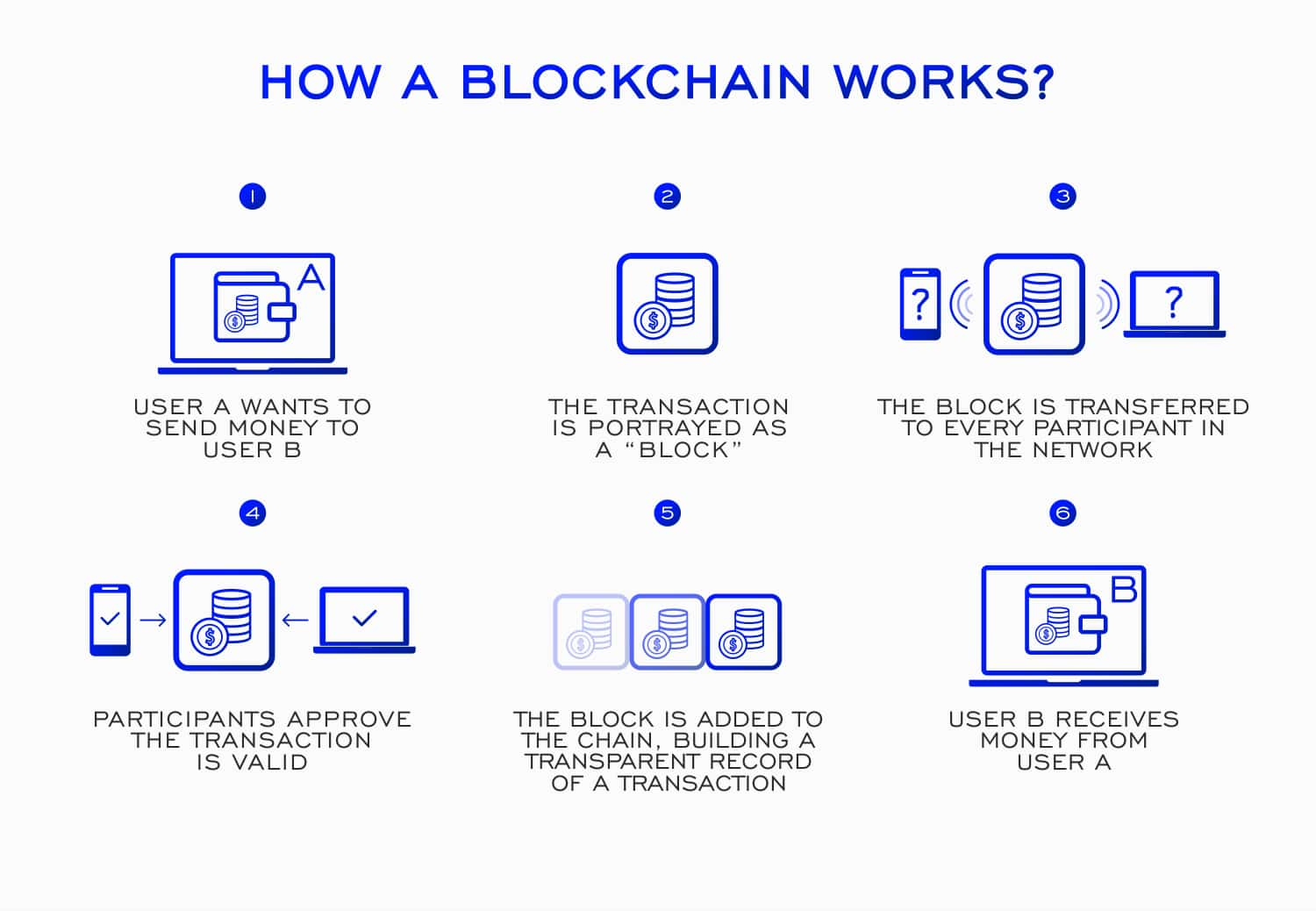

Blockchain technology is a method of recording data to create a digital collection of financial accounts (ledger) of transactions or contracts. This data is distributed across hundreds of computers and other devices to give access to up-to-date information.

The name itself is derived from the fact that data is recorded in blocks and stored in a linear chain. Each block of data draws on the previous block of data in the chain to ensure the data contained throughout the chain has not been tampered with at any stages.

Name at least one real blockchain based crypto project which provides financial services?

PCI DSS for Crypto Projects? What Does it Mean?

In fact, PCI DSS is considered to be a sort of manual for the action in relation to the crypto projects. It is still the top best practice for the cyber security.

PCI DSS compliance demonstrates data-security platform that is ready to address risk, taking into account any aspect of payment-data protection, monitoring, and governance. PCI is a compliance standard set by the major credit card companies. It doesn’t apply to transactions that do not use credit or debit cards.

Read our article “Top 5 Myths of Cybersecurity” to reveal the most common prejudice regarding cybersecurity.

In addition, read the article related to the most effective cybersecurity apps that will be helpful in 2019.

There are many cases of hacking of crypto financial services. The fast-growing industry makes the owners of crypto services move as fast as possible in developing the structure of the service and scale them exponentially. However, haste makes waste in the end, due to the lack of sustainable security measures. Thus, the number of exchange hacks doubled since 2017 and the number of crypto assets hacked were multiplied by 13 times. Even though the crypto becomes more mainstream, the problem is not going away.

So, based on the information above, we could state that some crypto projects are based on the blockchain (while claiming the opposite). In fact, all of them are similar to the structure of the basic financial services, like card processing, e-wallets, exchanges, and other intermediaries. Therefore, all business who involved in financial services should take care of the security of own funds as well as funds of their clients. Until the moment this or that project will confirm its actual blockchain structure, all of them are still subjects of vulnerability and server based. This situation required to obtain PCI DSS certificate or at least some sort of similar structure for the preservation of information.

What Kind of Benefits does PCI DSS Provide for Crypto Projects?

PCI DSS is a major security tool that ensures:

Elimination of security breaches. at the age of cyber attacks and malicious hackers, the matter of security is a predominant challenge. It is a necessity to contribute to the security measures to guarantee the sustainability of the online activity.

Build a security standard. PCI DSS create the baseline of security practice.

Increase users confidence. Each and every customer can be confident in their financial operations online.

Strengthen business cooperation. For each business using the services or cooperation with a particular company with PCI compliance is a guarantee of a reliable partnership. Moreover, it is an opportunity to build a company image by following the safety measures of digital financial activities.

PCI DSS is an indicator of quality. Due to maintaining security and managing cyber risks the financial licenses could be obtained.

Sustainable cryptocurrency exchanges. Additionally, cryptocurrency exchanges that are used for buying, selling and exchanging cryptocurrencies for traditional currency, usually break down in result of data breaches and malicious cyber attacks.

Conclusion

PCI DSS is a relevant method to maintain the security of online operations and allow to produce high-quality services. However, you should not consider this system as a panacea, but rather as a beneficial opportunity to strengthen the position of crypto sites at the moment.

It is crucial to realize that with the implementation of PCI DSS, the system of technology development might be more complicated. In fact, the mentioned system is a valuable addition to the protection of crypto projects. Just don’t forget to take care of the security measures as well as new features for your product.

It is suggested that security approach is required to be obligation until every industry and business will switch to the FinTech. But up to this time following traditional rules of security - will help to have a competitive advantage and become the leader in the industry.

Building the project with the structural composition and following security standards like PCI DSS from the very beginning might be resulted in putting off the release for years. But still, you should not neglect the security issue. That is why even from the very start you should take the best practices from PCI DSS manual.

In case you have left any questions or you have any suggestion, feel free to contact us and we will help you in any inquiry!