Money is the blood and bones of your startup. At the same time, raising money is extremely hard. As an entrepreneur, you need to carefully work on your fundraising strategy and know all the nuances of early-stage startup funding.

Show Table of Contents

One of the biggest obstacles to starting a business is finding capital to bring your idea to life. Startup fundraising is one of the most important issues for any entrepreneur. According to statistics, about 50% of new businesses are unable to pass the five-year mark.

So, at the start of the business, it’s better to decide how to construct an effective fundraising process. This article aims to help founders navigate through the labyrinth of early-stage fundraising strategies for startups. While creating this article we worked closely with Slidebean - a team who helped thousands of startups to create the pitch decks. Our goal was to explain the art of startup fundraising with all its pitfalls and how you could avoid them. So, let’s begin from the basics!

1. How Does Startup Funding Work?

Finding and engaging investors to your startup is not easy. Investor expectations are high, as is the competition. Not only that, but the process can be physically and psychologically challenging for founders, who are likely to raise any objections before they attract the right investor.

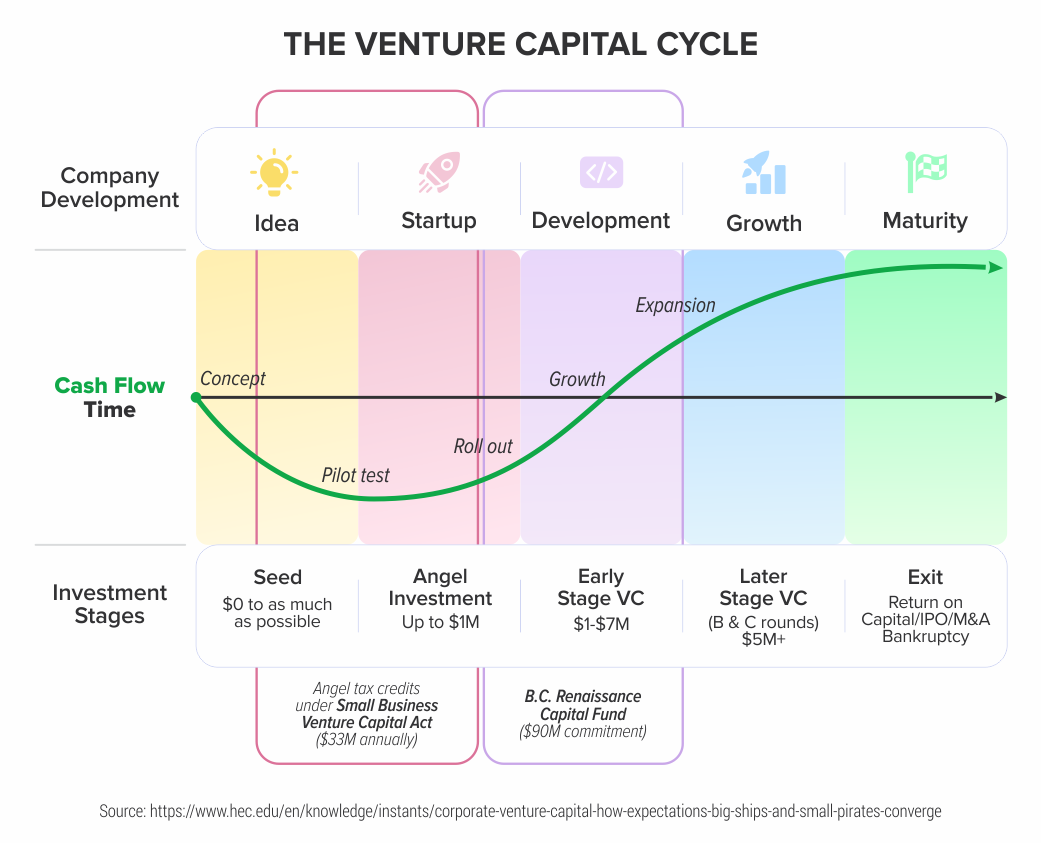

Even though after you've secured the initial investor, the reality for most startups is that they get just the right amount of funds to reach the next milestone. After that, startups usually return to fundraising several times to attract new investors and raise more capital to keep growing. This process is often repeated every 12-18 months in the early stages of a startup. Each of these raises is known as ‘funding rounds’.

The name of the round refers to the stage of business development. It's beneficial for both startups and investors. In this case, startups know which investors to approach and which are not. And investors understand which startups are suitable for their segment of interest and don't have to work on irrelevant startup applications.

For example, if a startup is looking for seed funding, but sees that the investor focuses only on investments in businesses in the later stages (from round B and above), then it makes no sense to waste the time of this investor and his team. This is matchmaking - look for someone who suits you.

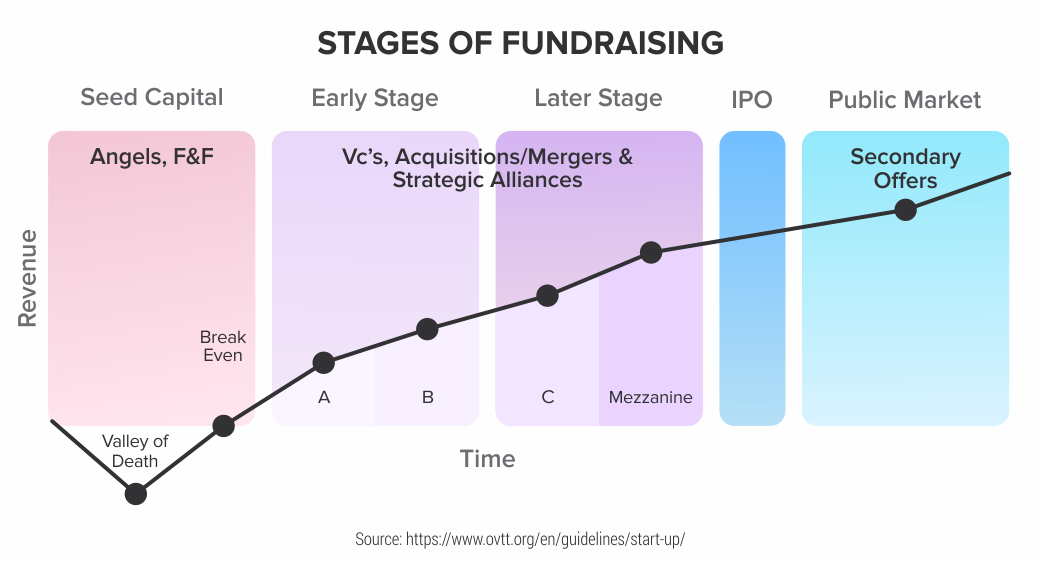

So, startup funding rounds are stages of raising funds to get to the next level of business development. Startup capital startup funds are initial money that is raised through investments to start a business. This money can be used for any business-related expense, including buying equipment, marketing campaigns, and product development. There are 3 main startup funding stages and sources of investors.

What are the major stages of startup funding?

Funding rounds for startups are divided into a pre-seed stage, seed stage, Round A. All other stages are late - they are named by letters (Round B, Round C, Round D, etc.). A funding round can take anywhere from 3 months to over 1 year, depending on the type of industry and investors. The time between each round can change between 6 months to 1 year. Funds are offered by investors (angel investors or venture capital firms) which then receive a stake in the startup.

To prepare for funding rounds, you must have clear goals, budget and collect data, research investors, and create a presentation. Storytelling is the key to a successful presentation. Know your audience, metrics and develop your style.

- Pre-seed funding (own resources)

This is the first real stage of funding a startup. Often at this level, funds are received through friends and family members. Plus, this stage is also often used to pitch a startup idea to those interested in financing your idea.

The goal of the pre-seed stage is to test the hypotheses of your startup, choose a vector of activity (along with a fundraising action plan) and turn the hypothesis into a real-life product. Seed funding investments usually range between $10,000 to $2 million.

- Seed funding (Angels)

When the product is ready, you can go for seed-round. At this stage, startups usually seek to raise funds for further research, key hires, testing product-market fit (your product solves a real customer problem, for which the customer is ready to pay money), and product development.

Business angels, targeted funds, accelerators, and incubators are often the ones who invest the most in this round, as they can provide start-up capital of $10,000–100,000. Larger seed venture capitalists (VCs) with at least $50 million in the capital are also regular seed investors as they are willing to take more risks in a business they believe will work.

A common strategy among seed founders is to invest in several new ventures to see which ones gain traction. Those who start making money with their idea are then given priority for subsequent rounds of funding. Some of the firms that operate with this model and have achieved success include 500 start-ups and SV Angel.

The popular seed-stage investors include Y Combinator, Techstars, Bain Capital Ventures, and Entrepreneur First.

- Rounds A, B, C (VCs)

By the time a business reaches Series A funding levels, the company should be able to provide real data to potential investors and have a solid idea of how much money the business can generate. Investors are looking for a high return on investment (ROI). Series A, B, and C rounds must build on a solid foundation of product development and market research.

Round A is focused more on startups that have an actual business model that will elicit an immediate profit. Round A investments can collect $2 million to $15 million. Typically, Round A investors are venture capital firms.

Previously, investors were invited to participate, provided that they had the funds to take the enterprise to the next level. By the time companies reach Series B, they are looking for the number of funds a venture capitalist can provide as the funding they seek falls in the tens of millions of dollars. By the time the business is ready for Series C and subsequent funding, it will likely have a startup worth over $100 million.

Well-known investors in the early-stage funding rounds include Accel, and Sequoia Capital.

Caya, the CEO of Slidebean answered: There two the most crucial points to keep in mind during every stage of fundraising:

Making sure that you have the traction needed for the round you are raising.

Making sure that the funding is enough to reach the next fundable milestone. If you are raising Seed, find out what the metrics are for Series A, and make sure that the money you are raising (and your financial projections) allow you to reach that milestone, with enough room to make some mistakes along the way, and enough room to actually close that round.

2. How to Raise VC as an Entrepreneur?

Raising money for your business is hard, especially at the early stage of a startup. We recommend you watch the video explaining how to raise seed funding for startups. Below there are excerpts from the video with crucial points.

Business Traction Requirements

Traction usually comes in the form of revenue or customer response to the product. The higher the traction, the more investors will pay attention to the company. Consequently, the more investors are attracted to the startup, the more funds are available to help your business succeed.

Keep in mind, however, that the relationship between traction and investors can also be tricky, as investors want to make money. Though a startup with good traction will attract investors, demands for profitability and returns can compromise a startup’s ability to put funds into building the business. Therefore, you want investors patient enough to ride out short-term losses in favor of a longer-term payoff.

Startup Pitch Decks

Early-stage startup funding is dependent on a killer pitch deck. Having a strong and effective sales pitch is the main reason for investors to fund your startup. There is a standard pitch deck template most investors expect to get.

Follow these top steps for nailing your investor pitch:

Don’t make your presentation longer than 10-15 slides. Plus, keep your presentation within a 20-minute time.

Be specific. The pitch deck is a story of your company so be specific on your idea and value and leave the complex tech-specific and advanced revenue projections for the follow-up meetings.

Be clear and concise. Most investors take about 4 minutes to review the deck to make the final decision. So no point in adding the supplement information.

Don’t treat your pitch as top-secret. As an investor who looked at hundreds of pitch decks every year the chances of signing NDAs for every case is very minimal. So, no investor will sign NDA for a chance to see a pitch deck.

Execute ideas. Ideas will be only ideas without execution. If anyone seeing your pitch deck can go and copy your idea and create a company of their own, then it might be not a great idea, to begin with.

To create a killer pitch you need to have a clear understanding of your startup idea, value and products/services. You should have a deep knowledge of your niche and what sets your startup apart from competitors.

Caya, the CEO of Slidebean answered: Keep in mind that based on your pitch deck every investor can clearly see whether this guy is or isn’t ready for a pitch. How?

If he/she asks investors to sign an NDA.

Using vanity metrics like downloads, sign-ups, social media followers instead of revenue, or MAU.

Having an unclear go-to-market strategy.

Don’t have some traction to tell about.

Not being able to explain how they are going to use the funds.

How to Find Investors for a Startup

Getting in touch with hundreds of investors is not an easy task. But don’t expect that every investor you speak to will be ready to fund your business. The first thing to know is which type of investor you are targeting.

For example, VCs and Angels are usually interested in tech, high-growth, high scale companies. The companies that can raise $1 million as a seed round and use that to get them to $4-5 million Series A stage in 18-24 months. This means that the companies grow 3 times annually and have a huge market opportunity.

If your business can’t sustain that sort of growth, a founder should aim for different kinds of investors. The good practice will be to extend your LinkedIn network and attend startup events. Connect with everyone you know and carefully review their connections. If you find a match, check if the investors are actively investing (for this purpose you can use AngelList). Don’t use the tactic of cold emails, that will ultimately eliminate the chance that your pitch deck will be reviewed.

To manage your investors, create a spreadsheet with the information of every conversation you have and the status of your relationship.

Alternative Funding Sources

Accelerators or Incubators: Accelerators or incubators are often public-private partnerships that provide training, office space, and sometimes cash for tech startups.

Crowdfunding: This has become a popular way for private investors to fund startups. There are traditional sources of crowdfunding like Kickstarter or Indiegogo, as well as equity funding through accredited or non-accredited investors.

Loans: These loans are provided by investors to finance a startup with the promise of a share of the startup's income. Secured Bank or Venture Loans: These loans are available to startups that usually have assets or property that can be used as collateral.

Business Plan Competitions: These local competitions are often a good way to win money quickly and in some cases even get free consultants.

3. Step-by-step Guide on Fundraising Development Plan

Regardless of your startup idea and your goals, one thing remains the same - you need to have a fundraising strategy.

A fundraising strategy indicates how you plan on going about raising funds for your business. Ideally, it is a written document that clearly responds to these five questions:

Why - Why are you raising capital?

Who - Who are you raising the capital from?

How much - How much capital will you raise? (Now and in the future)

When - When are you raising capital? (Now and in the future)

How - How will you go about raising the funds? (Process)

So, that’s how you can answer those questions and build a fundraising action plan.

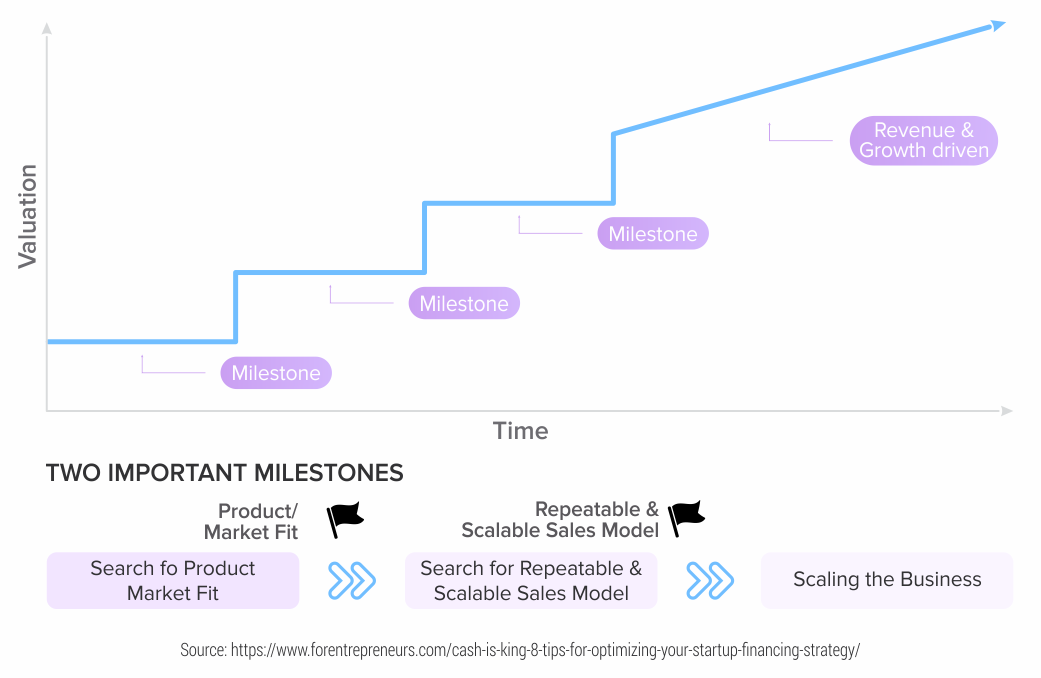

Step 1: Understand how startups are valued

Startup valuations are based on a calculation of risk and reward. Valuations increase as the level of risk goes down. In practice, the risk is not reduced linearly over time but instead changes in big increments when particular milestones are reached.

There are two important milestones, in our opinion:

Finding Product-Market Fit

Finding scalable sales model

Usually, the single biggest way to show that risk is being reduced is to show evidence of increasing traction with paying customers. If a significant number of customers are willing to pay for a product, that tells an investor many positive things:

The company has reached product/market fit

The monetization strategy is working

The technology works

The team has shown some ability to execute

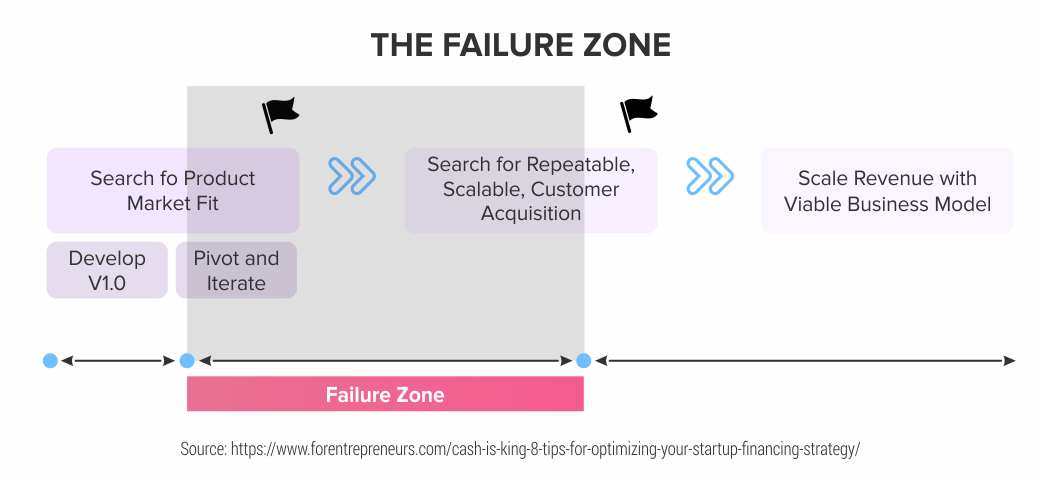

There are three phases in a startup lifecycle. The first phase is the search for product/market fit. Increasing customer traction is the best way to prove to investors that you have reached product/market fit. The second phase is the search for a scalable sales model. Reaching this milestone will greatly increase valuation, and attract growth stage investors who like to invest in companies that are ready to scale.

Once a startup enters the third phase, Scaling the Business, it will usually start to see its valuation increase linearly as a multiple of revenues or profitability.

Caya, the CEO of Slidebean answered: The crises (e.g. COVID-19 pandemic) influenced the process of startup funding as any other sector of our lives. In the early stages of the pandemic, it’s likely that valuations dropped a bit; meaning that investors were extra careful about their cash, to ensure they had enough money to help their existing portfolio if needed.

Nowadays, things slowly continue to be back to normal, so apart from mastering remote meetings, founders should focus on designing a strong startup strategy.

Step 2: Set goals and time limit

An all too common mistake that many early-stage startup companies make is going into fundraising blindly.

Take time to understand what you need the money for? What are you going to accomplish with the money that you raise? What are the milestones it will help you hit (e.g. speed to market, grab market share, exploit a market opportunity)? And don’t forget that investors don’t fund capital shortages, they fund opportunities.

Setting clear, specific, achievable, measurable and time-bound goals is invaluable to creating an effective fundraising strategy.

Finally, don't let your fundraising drag on for months on end. VCs need to be incentivized to make a decision, otherwise, their deliberation might go on forever, as they pay attention to other more time-sensitive deals and continue collecting more information about your company.

Step 3: Research the investors

You’re choosing investors as much as they’re choosing you. Investor research should be considered a must-do prior to fundraising. It should be based on two principles: targeting the right investors and doing unbiased research.

Find out more about who your investors are, their strengths and weaknesses, and ways they can add value to your company in addition to their investment.Make sure your investors are the right fit in terms of your stage sector, geography, and ticket size.

Note: There are multiple funding sources out there in addition to VC funding. Your fundraising strategy should clearly outline all the current/planned funding sources (investors, incubators/accelerators, customers, bank loans, personal savings, bootstrapping, and more). These often come in a progression in an early-stage startup’s life (all the way from bootstrapping to venture capital).

Step 4: Determine your specific risks and how to mitigate them

The nature of risks can vary greatly from one startup to another. For example, risks may depend on an unproven team, wrong market timing, crowded marketplace with significant competitors, etc..

Surely, you cannot completely avoid risks, but it’s in your power to mitigate risks before fundraising. Thus, even in this early stage of the business, any proof of customer traction can greatly decrease the risks of your startup and increase valuation. This could be accomplished by sketching wireframes of the application and showing these to customers. The goal would be to get enough customers to validate that this meets a real need that is sufficiently serious that they are keen to start using it as soon as it launches and willing to pay for it.

If you were able to walk into an investor meeting with a list of 20 customers that were willing to share their experience with investors, your chances of getting funded would go up substantially, and your valuation would likely increase.

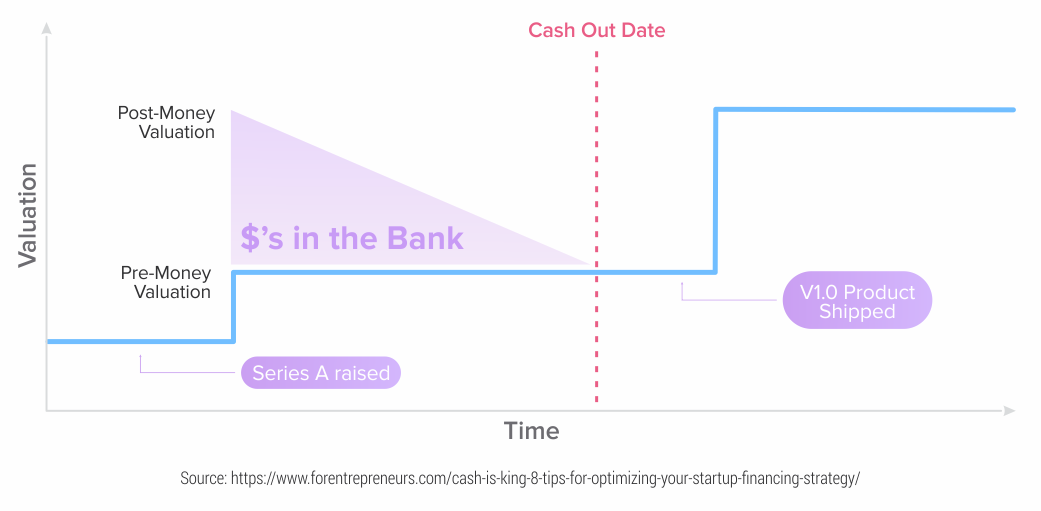

Step 5: Your cash needs to match the milestones

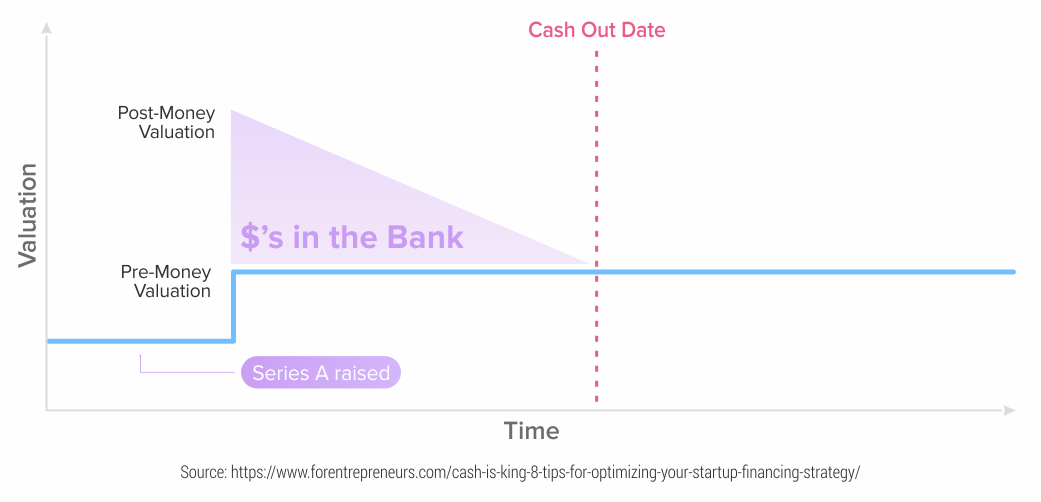

In addition to knowing who you’re raising capital from, it’s crucial to know which amounts you’re hoping to raise from them. You will want to figure out what milestones could be reached before you hit your cash out date. You may well find that your current strategy is targeting a milestone that cannot be completely achieved with the cash you have in hand. If that is the case, you could be setting yourself up for a down round.

The best strategy here is to do one of two things:

Reduce your burn rate to allow you to complete the milestone before you run out of cash.

Pick a different intermediate milestone, and ask investors if reaching that will allow you to successfully raise an up-round.

As an example, we have met several tech startups that have funding that lasts only three months. For certain types of companies, three months is enough time to build a product and get some customer traction. However, for the majority of them, three months is not enough time to get an MVP (minimum viable product) built.

As are a result, they will not be able to show either a finished product or customer traction. No customer traction will make it very hard to raise their next round. Reaching that milestone will be more important than showing a product that is not far enough along to put into customers’ hands.

The failure zone below shows where most startups fail. If you are financing to get through this zone and have any level of concern, it pays to take more cash.

When raising a round of funding, identify the next target milestone that you’d like to reach to significantly de-risk the business. Reaching this will enable you to raise an up-round.

Once you have identified that milestone, do some hard thinking on how long it will take you to reach that point. Then add three months of cushion for the time it will take to meet with investors to get the next round raised.

Knowing that time frame will allow you to figure out how much money to raise. A common mistake that entrepreneurs make is to focus too heavily on avoiding dilution by raising less money. Another common problem is a failure to build enough cushion for the unexpected. It’s pretty common for software development to take longer than planned, or for sales to take longer to ramp than hoped. Raising more cash to provide a cushion is often a very smart way to decrease overall dilution, as it will allow you to optimize the subsequent round.

Step 6: Avoid a down round at all costs

Down rounds is a serious problem for a startup. Not only are you raising money at a lower valuation, but you will also trigger the anti-dilution clause from your previous investment round.

Down rounds happen because you failed to reach the milestones needed to grow into the valuation set by the post-money of your last round. Right after closing that round, your company would have been able to justify that post-money valuation because of the cash sitting in the bank. But as that cash gets spent, your valuation will drop, unless you reach the next milestone.

Most of the time down rounds are caused by a failure to execute. That is why it is so important to plan correctly and then execute according to plan.

Step 7: Make a process out of the plan

Fundraising should be approached and managed as a process. Once you have your fundraising strategy, it’s important to use it as a guideline for your fundraising activities. Your fundraising strategy should clearly outline how you’re planning to reach out to every investor – through which channel, when, and how.

You will make your life easier if you automate some of the processes and prepare as much as possible. Have a sturdy CRM containing all your potential investors and the information about them. Create a system that will contain all the information you need on each investor and where you’re at with them in the process (emails, meeting notes, reminders, etc.)

Have all the necessary documentation that investors are looking for ready at all times (KPIs, cap table, term sheets, financial model, contracts). Not only does it make it easier for you, but the investors too.

4. Top Mistakes During the Startup Fundraising

The CEO of Slidebean, Caya shares the top startup funding mistakes in terms of pitching and how you can avoid them:

- Fundraising too early

You can quite literally never be too early. Funding exists as early as an idea (or lack thereof) and all the way up to just before an IPO.

“Fundraising is a full-time job for the CEO, companies need to be sure of when to make that commitment so that the company growth doesn’t slow down because their CEO is out.”

There’s obviously a caveat— know your audience. If you’re pre-seed and you pitch someone that exclusively funds Series A rounds, you’re likely too early for them. On the flip side, you can also pitch a party that’s too early for you.

It’s really about finding the right investor, and understanding where you are with whatever it is you’ve built. Understanding your true stage and the relationship you have with who you’re pitching is imperative to a successful fundraising process.

- Being overly focused on fundraising

Most entrepreneurs place too high a premium on fundraising. Of course, certain types of businesses need a huge up-front investment. Tesla is a good example because it required a lot of complicated technology to build. Not many people have the $5,000,000 in cash lying around that’s required to start an electric car company.

But plenty of businesses were able to become mass successes without huge investing at the beginning. Too many entrepreneurs think they won’t have a business at all unless they’re raking in investment dollars. And that’s just not true. At the end of the day, getting your company off the ground takes a combination of know-how and luck. So be patient. Focus on building a solid business first. And when it comes to seeking investor dollars.

- The wrong Total Addressable Market (TAM) estimation

The huge mistake that the majority of startups make is being too broad on the Go-To-Market strategy and estimation of TAM.

“Slides, where founders make mistakes all the time, are the Go-To-Market slide (founders are too broad about how they are going to get customers) and the TAM slide (doing top-down market estimations, vs bottom-up).”

Total Addressable Market is the total market demand for products/services. A lot of startups are taking a top-down TAM approach. The logic behind this is simple: if it’s a huge market then getting 1% of the market is great. In fact, the right estimation of TAM is going the bottom-up way, meaning you have to document your assumptions and show how your TAM comes together.

5. Why We Wrote This Article? - Inspired by Slidebean

As a startup tech partner, our aim is to help founders make the right decisions and build successful businesses. That is why once finding useful content, we are glad to share it with our readers.

We found Slidebean’s YouTube channel and instantly became the fans of their work. The team created valuable content - brief, clear, and up to the point about pitching for startups. Reviewing their story of success and the services they provide it’s difficult to stay indifferent to the work these guys did. (It’s not a sponsored article, we simply want to spread the word about this team.)

Slidebean is a platform for startups and small businesses to create professional investor decks and sales presentations. Powered by Artificial Intelligence, the platform separates the content creation from the slide design which allows users to build presentations in seconds.

Plus, Slidebean design services help founders with writing/design pitch decks or redesigning the existing ones. The team helped thousands of startups raise their capital. For example, UpKeep, the first mobile app for maintenance collaboration, raised Series B with the Slidebean deck.

Being ourselves a software development company we are facing pitches from early founders on a daily basis. And while having great ideas, a lot of early-stage startups lack the knowledge and experience in terms of fundraising.

That is why we decided to reach out and collaborate with the Slidebean team. We wrote this article about the importance of building a solid fundraising strategy based on the questions we asked Caya, the CEO of Slidebean.

As an entrepreneur, you need to carefully work on your fundraising strategy and know all the nuances of early-stage startup funding. So, step by step your startup will grow and eventually you could scale your business and develop a more advanced version of your product.

At all stages of app development, you should think of a reliable tech partner who can help you to build your new product. As a software development team, we know the importance of building robust and scalable web and mobile applications from the start. 2muchcoffee has 5+ years of software experience and helped 20+ startups to become leaders in their market (EdTech, mHealth, FinTech, Sustainability).

Our task is to support you with existing projects or build a new one from scratch based on your requirements and market trends. Design, software development, code review, and other services for startups aim to boost your business growth. Your success is our success, so drop us a line to stay in touch!

Bonus: Create Your Budget From the Start

A financial model is an essential part of a successful business. It is a crucial tool to evaluate the potential of the company. How much do you plan to charge for your product? How much do you expect to pay to acquire a customer? How much time do you need to finish developing your product? Without answering those questions, your costs will easily outweigh your income and your costs will exceed your limits.

Investors do not expect to see looking-good numbers on the graphs. They expect founders to do maths and estimate the money they need to get to a milestone with an accurate number of expenses.

And the project launch budget itself can be divided into three parts:

Development (product prototyping and strategy creation),

Production (product creation),

Promotion (marketing and advertising campaigns in order to attract customers).

So take your budget seriously. And be sure to put it on paper or digitally. But don't rely on being able to keep everything in your head. Because it doesn’t work.

Final Thoughts

The ecosystem for early startup financing is far more complex now than it was only a few years ago.

Fundraising is a painful, but necessary task most startups have to periodically endure. But with enough persistence, dedication, and grit – the hill can be climbed, and the view will be awesome!