In every business, whether it’s a startup or an already established business money is the blood and bones of everything. So if you run out the cash then the business dies. Too often though, small businesses make a variety of financial mistakes that allow their hard-earned money to leak away.

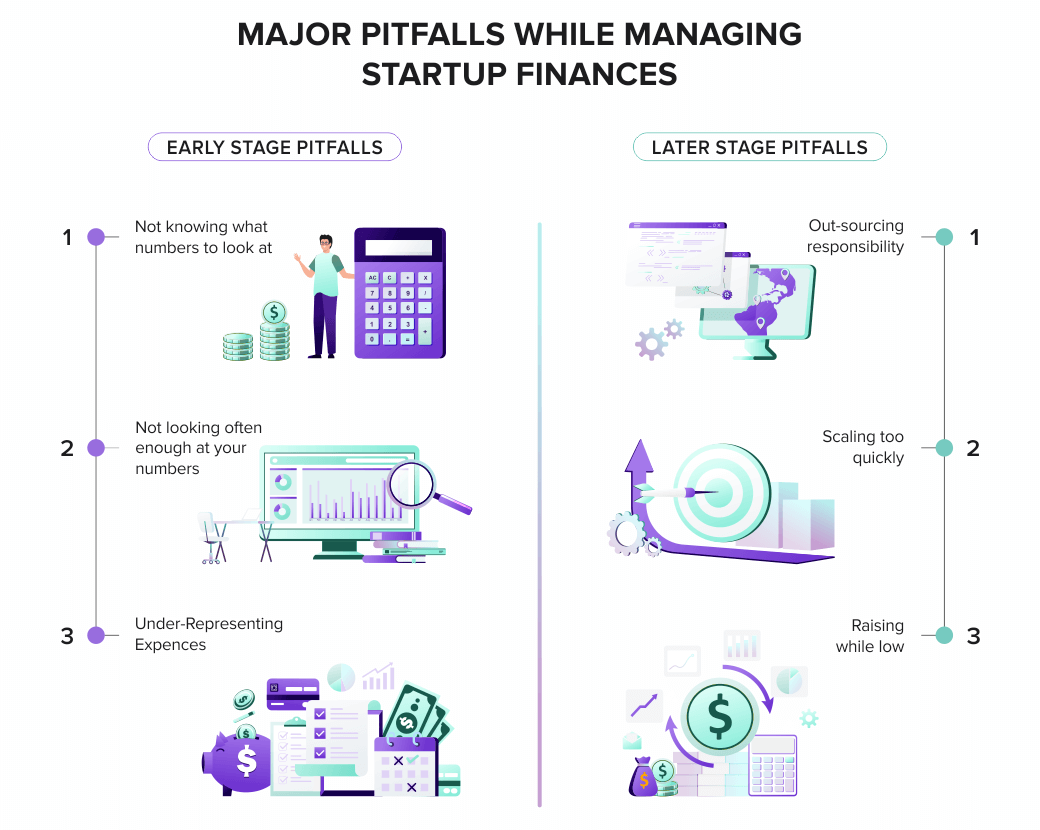

While it’s surprisingly easy to run out the cash, we framed the major financial mistakes of startup development for you. The article focuses on common pitfalls at the early and later stages of business development and will be useful for every founder.

1. Not knowing what numbers to look at

According to some recent surveys of new business owners, approximately one third admitted to underestimating monthly expenses. Along the same lines, almost 20% of new business owners realized that they didn’t have enough financing. It’s all too easy to miscalculate your operational costs, so initial financial assumptions are often off.

And while keeping track of all of your startup expenses will minimize these miscalculations, still, a lot of founders may not know what numbers they should look at. This is the very first and most common reason for the financial failure of many startups.

There are 3 things you need to know in terms of basic financial numbers:

Bank Balance

Money coming in

Money coming out

There are simple numbers that do not require bookkeepers or accounts. All of these you can find in your bank statements. These are the numbers to look at to make sure that the financial health of your company is good.

So, if you know bank balance, money coming in and out you can calculate:

Burn Rate: which is your Expenses - Revenue Your burn rate is the amount of capital you go through every month to keep your business running. If you don’t have a good understanding of your burn rate, you are seriously hindering your ability to achieve your milestones before your money runs out.

Runway: shows you the number of months of how long do you have until you run out of money. For calculation use Bank Balance/ Avg Burn = the number of months

Growth Rate: the best way to know your growth rate is Revenue (month 2) - Revenue (month 1) / Revenue (month 1)

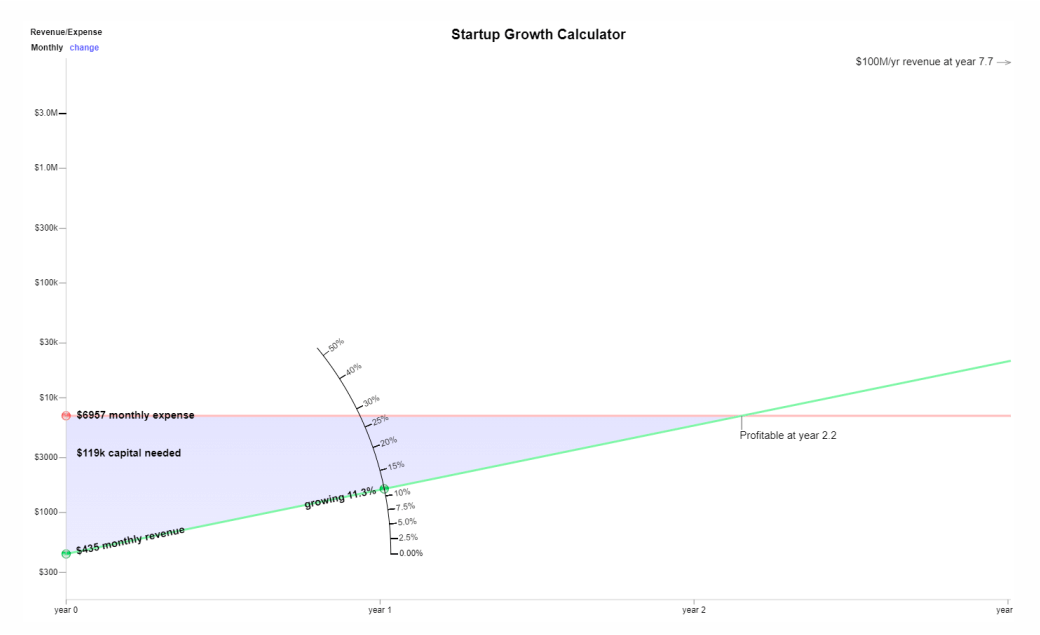

Default alive: is a startup company that is on track to make it to profitability with its current resources. In other words, revenues will cover expenses before cash runs out. To calculate default alive you can use the following graph.

The first step in managing for cash flow is to create a bottom-up projection, using real-world variables. Top-down forecasting can lead entrepreneurs to be overly optimistic about the sales they’ll close and the revenue they’ll earn. Bottom-up forecasting will give you a more realistic (albeit a less inspirational) gauge of how much money you’ll need to get going—and keep going.

2. Not looking often enough at your numbers

If you think to check the numbers once a year or even every quarter is enough - you’re wrong! You should check the numbers every week, at least. At the very beginning of startup development, we recommend checking out the numbers a few times a week or even daily. When someone asks, you should know your numbers. The more you aware of your financial situation the better for your business.

3. Under-Representing Expenses

Expenses do not remain constant, so be ready that there will be some extra expenses even at the very start of your business. In addition to the recruitment and salary costs, there are additional physical costs such as a necessarily larger office space, equipment, and supplies. There’s also the psychological cost: what will happen to these people if your company doesn’t grow and you need to lay them off? And don’t forget the all-important reputation cost as well: how will it look to investors and others if you have to disassemble your team?

4. Outsourcing responsibility

Quite often the CEO will hire the bookkeeper to prepare the finances for the company as they start to get more complex. It’s a normal thing to do. Even if the bookkeeper prepares the reports the responsibility is on the whole team and particularly on the CEO. Everyone is responsible for the numbers.

It’s up to the founders and team to look through the reports that were sent by the bookkeeper every month and understand them and ask questions if you don’t understand the numbers.

5. Hiring and Scaling too quickly

One of the greatest expenses of any company is its people. To keep your costs low, you need to consider ways to save money on staffing. A big mistake many startups make is to hire too quickly. Too many employees is a huge drain on your funds.

The best startups do more with less. Actually, the real way you should measure yourself is by asking yourself: what’s my ratio of revenue to employees. Because the higher that is the better you are doing which equals you’re doing more with less.

Don’t follow trends and hire data scientists because other companies do it. Some companies do more with less. And if you can build a really good company with fewer employees then this is amazing for everybody involved.

Treating money carefully since this is not the case of simply hiring people. Investors who are giving you this money for, asking you to take their money and turn it into 10 or 100 times that amount of money to give back to them.

You should avoid hiring until Product-Market fit. Another dangerous thing the people fall into quite easily. At the moment where you still figuring out your product’s product-market fit, you should be spending as little as possible. And that will give you a runway to have time to figure out what is it you should be building. More employees do not help you reach Product-market fit.

For example, thinking that you need 4 more devs because then you can build additional features so people will buy the product is a wrong assumption. First of all, solve the big enough problem so users will be willing to pay for the application and love your product and then you can start building in more features and hiring more people to expand the product.

6. Letting runway get too low before fundraising

If you let your runway get too low before rising you gotta have problems raising your money. So, the first thing you should assume you’ll never raise money again. Think that the previous money that you raised was the last and you should be aiming to profitability on that money. Stop relying on your investors constantly giving you money.

Seed stage money is to help you reach Product-market fit.So, you’d be talking to investors about the idea or hypothesis you’d like to check and they will get you some money. Once you get a series A and beyond expect sustained growth, you need to have more of the idea, to have product-market fit. That is why it’s harder to raise money as you go through the life of the company.

And in particular, don’t leave it too late because if you run out of runway your leverage goes down as you are trying to raise money. So if you have a six month of the runway and you think you’re about to start raising money that pretty scary. It will get three months or more to let the investor agree to put the money in. And as your cash balance is decreasing over those three months - you’re losing leverage.

How to not run out of money?

The truth is that managing your startup finances is not as difficult as most people think, because you can operate on a low budget while keeping track of your financial activities with technology. For example, a simple Excel spreadsheet can help you to track your cash inflows and outflows. Here are some of the great ways you can manage your startup’s finances from day one:

1. Manage Your Expenses

As a startup, you will be dealing with a lot of expenses from different directions. At the initial stage, hiring a full-time employee to be handling your cash inflows and outflows may not be budget-friendly. So, you may have to try using accounting software to do this task. This will be beneficial to you for many reasons. Besides helping with your cash flow management, it will also make it extremely easy for you to do tax time rolls annually. But you will need the services of hiring an accounting professional as the business begins to expand, and accounting will become more complex as you grow.

At the start of your business, you will never go wrong by lowering your expenses. In fact, it is important you try to do more with less funding. You don’t need to rent a luxurious office at the heart of your city. Always focus only on things that will take your business to the next level, not on things that you don’t actually need.

2. Maintain Financial Stability

As an entrepreneur, you need to keep your personal and business accounts separately – don’t mix the two. This is necessary so that you can actually save money for yourself, and protect yourself from liabilities resulting from legal or corporate debts.

Define your own job description in the business, and pay yourself your due earnings. Although this is your business, you do need to create a formidable financial plan for yourself. If you don’t know how to get this done, then you can talk to a professional economist, auditor, or accountant to assist you with details.

If you are facing severe financial hardships such as debt consolidation or bankruptcy, then you can seek the services of DMB financial. They will help you out of this situation as quickly as possible. Most entrepreneurs are not aware of this fact, and that is why their businesses unexpectedly go down the drain. You will never go wrong by maintaining financial stability.

3. Monitor & Measure Performance

As a new business owner, you really need to keep a track record of your business’ expenses. Your account department should be updating you with the financial transactions, and that includes both your past and present financial statements. Having an overview yourself is very important because it will protect your future revenue, expenses, and cash flow early on.

By staying up-to-date, you will know in clear terms whether your business is overperforming or underperforming. Monitoring your business performance is very essential as it will help you to maximize efficiency.

4. Focus On Your Niche & Delegate When You Can

As an entrepreneur, you are already spending much of your time and energy in harnessing your business potentials. So, you don’t have to make life even more difficult for yourself. All you need to do is to simply focus on your niche; you need to focus strictly on what you are good at, what you know and what you are passionate about.

When you do this, success usually comes much faster. Focusing on things that are not within your niche will make crash and burn quickly. Thus, focusing on what you do best is one of the most important things you can do today. You can delegate or outsource other areas you are not proficient in, such as customer support and administrative tasks.

5. Reduce Overhead

You need to sit down and create a competitive budget for your business. If you are spending too much on renting a luxurious office space, then you can consider sharing office space or going completely virtual instead. With this, it will be easy for you to achieve more with less funding and run operations on a highly competitive budget.

6. Understand & Plan Tax Payment

If you can’t understand and plan your taxes, then it will be extremely difficult for you to run your business. Often, entrepreneurs don’t personally get involved with tax issues but rather pay whatever amount their accountants tell them to pay. However, if you get into this matter and plan ahead you can reduce the number of business liabilities, save money, and create efficiencies.

Whatever industry your company is in – make sure to focus on the things you really need to strive for instead of the “nice-to-have’s”. Managing your business’ finances from day one will ensure success in the long run.

Check out:

Quick Tips As A Conclusion:

Know your cash balance and runway at all times.

Understand how your expenses are going to increase over time.

Understand that a high ratio of revenue: employees is a better metric than the number of employees.

Assume you’ll never rise again, so have a plan for reaching profitability.

Drop us a line if you have any questions about startup development. We gladly help you!